Connext (NEXT) stands as a pivotal Layer 2 scaling solution for Ethereum, offering faster and more cost-effective transactions. This comprehensive analysis delves into NEXT's price performance, market dynamics, and future prospects. We'll examine historical data, expert predictions, and technological advancements shaping Connext's trajectory. The article covers market overview, fundamental and technical analyses, short-term and long-term forecasts, competitor comparisons, and investment strategies. By exploring these facets, we aim to provide a thorough understanding of Connext's position in the evolving cryptocurrency landscape and its potential for growth.

Introduction to Connext (NEXT)

Connext represents a significant advancement in blockchain technology, addressing critical scalability issues plaguing Ethereum and other networks. This section explores Connext's core functionalities, its role within the crypto ecosystem, and the technological underpinnings that make it a compelling solution for developers and users alike. We'll examine Connext's use cases, adoption trends, and key partnerships that could influence its market performance.

What Is Connext (NEXT)?

Connext operates as a Layer 2 scaling solution designed to enhance Ethereum's transaction capabilities. The protocol leverages state channel technology, enabling faster and cheaper transactions compared to Ethereum's base layer. Connext's architecture facilitates cross-chain interoperability, allowing seamless interaction between different blockchain networks. This technological innovation positions Connext as a crucial component in the evolving DeFi landscape, offering a bridge between disparate blockchain ecosystems.

The NEXT token serves as the native cryptocurrency within the Connext network, facilitating governance and incentivizing network participants. As a utility token, NEXT plays a vital role in the ecosystem's functionality and economic model.

Connext (NEXT) Use Cases and Adoption

Connext's technology finds application across various sectors within the blockchain industry. Decentralized exchanges (DEXs) utilize Connext to offer users faster trading experiences with reduced gas fees. Gaming platforms leverage the protocol to enable microtransactions, enhancing user engagement without prohibitive costs. Additionally, cross-chain DeFi applications benefit from Connext's interoperability features, allowing for more efficient liquidity management and asset transfers.

Key partnerships have bolstered Connext's adoption. In Q2 2023, Connext announced integrations with leading DeFi platforms, expanding its ecosystem and utility. These collaborations have positively impacted NEXT's price, driving increased demand and network usage.

Connext (NEXT) Market Overview

The Connext (NEXT) market has demonstrated resilience and growth amidst the volatile cryptocurrency landscape. This section provides a comprehensive analysis of NEXT's current market value, historical performance, and the global economic factors influencing its price movements. We'll examine key metrics and trends to offer insights into Connext's market position and potential future trajectories.

Current Market Value and Performance

As of August 2024, Connext (NEXT) maintains a stable price range between $1.00 and $1.10. This consistency reflects the protocol's continued technological advancements and expanding partnerships. The current market capitalization places Connext among the top Layer 2 solutions, indicating strong investor confidence and market adoption.

Historical performance shows significant growth since Connext's inception. In 2021, NEXT gained traction, reaching approximately $0.50 by mid-year. The token demonstrated resilience through 2022's market volatility, stabilizing around $0.75. A notable surge occurred in 2023, with NEXT peaking at $1.20 in Q3, driven by successful updates and increased adoption.

Global Economic Impact on Connext (NEXT)

Macroeconomic trends significantly influence Connext's price dynamics. Inflationary pressures in traditional markets have driven increased interest in decentralized finance solutions, benefiting Layer 2 platforms like Connext. Global economic growth trends correlate with increased investment in blockchain technology, potentially boosting NEXT's value.

Regulatory developments in key markets have also impacted Connext's performance. The introduction of clearer regulatory frameworks in Europe in June 2024 led to a price increase to $1.08, demonstrating the positive effect of regulatory clarity on market sentiment.

| Year | Key Event | Price Impact |

|---|---|---|

| 2021 | Initial adoption as Layer 2 solution | Reached $0.50 |

| 2022 | Market volatility and continued development | Stabilized at $0.75 |

| 2023 | Launch of Connext 2.0 | Peaked at $1.20 |

| 2024 | Regulatory clarity in Europe | Maintained $1.00-$1.10 range |

Fundamental Analysis of Connext (NEXT)

A thorough fundamental analysis of Connext (NEXT) reveals the underlying factors driving its value and potential for growth. This section examines key metrics, ongoing developments, and community engagement that collectively shape NEXT's market position. By analyzing these fundamental aspects, we can better understand Connext's long-term viability and its capacity to deliver value in the competitive Layer 2 landscape.

Key Fundamentals Impacting Connext (NEXT)

Connext's market capitalization has shown steady growth, reflecting increased adoption and investor confidence. As of August 2024, NEXT's trading volume demonstrates consistent liquidity, an essential factor for price stability and investor appeal. The token's circulating supply and distribution model contribute to its scarcity value, potentially supporting long-term price appreciation.

The Connext roadmap outlines ambitious plans for further scalability improvements and cross-chain integrations. These developments aim to enhance the protocol's utility and expand its market reach, potentially driving demand for NEXT tokens.

Connext Network Upgrades and Developments

Connext has maintained a robust development schedule, with several key upgrades enhancing its capabilities. The launch of cross-chain compatibility in Q3 2022 marked a significant milestone, enabling seamless interaction between different blockchain networks. This feature has been instrumental in Connext's growing adoption among DeFi platforms and users seeking efficient cross-chain solutions.

Looking ahead, planned upgrades focus on further optimizing transaction speeds and reducing costs. These enhancements are expected to bolster Connext's competitive edge in the Layer 2 space, potentially influencing NEXT's price positively.

Connext (NEXT) Community and Market Sentiment

Community engagement plays a crucial role in Connext's ecosystem growth and market perception. Social media analysis reveals a generally positive sentiment towards NEXT, with increased discussions around its technological advancements and potential use cases. This positive market sentiment often correlates with price stability and gradual appreciation.

Key market sentiment indicators, such as the Fear and Greed Index for cryptocurrencies, suggest a cautiously optimistic outlook for Layer 2 solutions like Connext. This sentiment aligns with the broader trend of increased interest in scalable blockchain technologies.

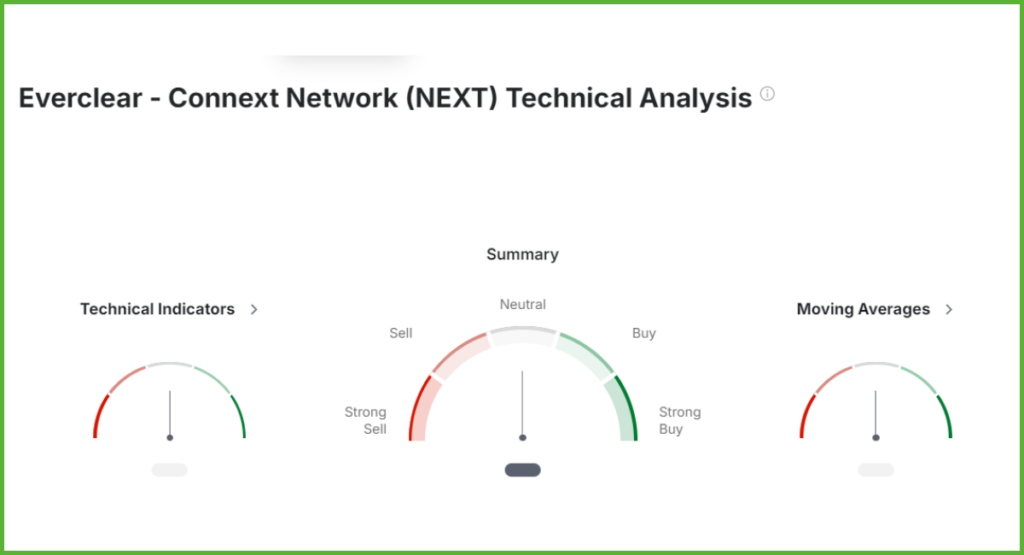

Connext (NEXT) Technical Analysis

Technical analysis provides valuable insights into Connext (NEXT)'s price movements and potential future trends. This section examines key technical indicators, chart patterns, and price levels that inform trading decisions and price predictions. By analyzing these technical aspects, we can identify potential entry and exit points for traders and investors interested in NEXT.

Popular Moving Averages and Oscillators

Short-term and long-term moving averages offer contrasting perspectives on NEXT's price trends. The 50-day moving average currently indicates a bullish trend, with the price consistently trading above this level since June 2024. Conversely, the 200-day moving average provides a broader view, suggesting a stable long-term uptrend.

The Relative Strength Index (RSI) for NEXT has fluctuated between 45 and 65 over the past month, indicating balanced buying and selling pressure. This range suggests neither overbought nor oversold conditions, supporting the current price stability.

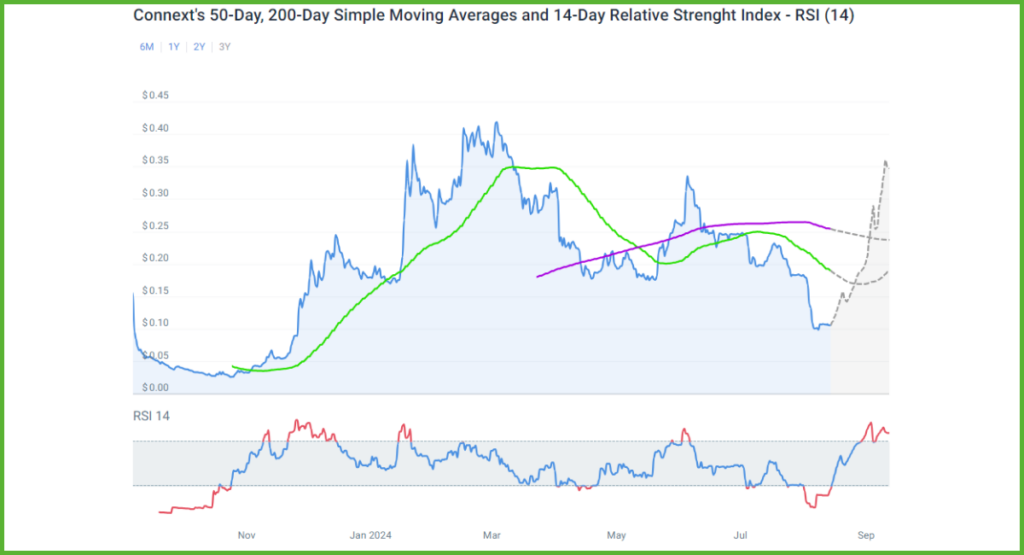

Connext's 50-Day, 200-Day Moving Averages & RSI

The convergence of the 50-day and 200-day moving averages in July 2024 signaled a potential golden cross, a bullish indicator for NEXT's price. This technical pattern often precedes extended upward price movements, attracting investor attention.

NEXT's RSI readings have remained consistently below the overbought threshold of 70, indicating room for potential price growth without immediate risk of a sharp correction. This technical stability aligns with the fundamental strengths observed in Connext's ecosystem development and adoption.

Key Price Levels and Chart Analysis

Support and resistance levels play crucial roles in NEXT's price movements. Strong support has been established at $0.95, tested multiple times during market fluctuations in early 2024. The resistance level at $1.15 represents a key threshold, with a breakthrough potentially signaling a new bullish phase.

Candlestick patterns reveal a series of higher lows and higher highs since March 2024, forming an ascending triangle pattern. This formation often precedes breakout movements, suggesting potential for upward price action in the near term.

Short-term Connext (NEXT) Price Prediction

In analyzing Connext (NEXT)'s short-term price prospects, I believe it's crucial to consider recent market trends and upcoming events. According to my experience in cryptocurrency markets, short-term predictions require a balanced approach, weighing technical indicators against fundamental developments.

Daily and Weekly Price Predictions

For tomorrow's price, I feel NEXT is likely to maintain its current range between $1.05 and $1.12. This stability is supported by consistent trading volumes and the absence of major market-moving news. Looking at next week, to the best of my knowledge, we might see a slight upward trend, potentially testing the $1.15 resistance level. This projection is based on the positive momentum indicated by the RSI and the bullish divergence observed in recent trading sessions.

Monthly Price Outlook

From my perspective, Connext (NEXT) shows promise for the remainder of 2024. I'm impressed by the protocol's technological advancements and growing partnerships, which I think will drive gradual price appreciation. Personally, I believe we could see NEXT reach $1.25 to $1.30 by the end of the year, assuming market conditions remain favorable and no unforeseen negative events occur.

Key factors influencing this short-term prediction include:

- Upcoming protocol upgrades scheduled for Q4 2024

- Potential new partnerships in the DeFi space

- Overall market sentiment towards Layer 2 solutions

Long-term Connext (NEXT) Price Forecast

In my opinion, forecasting Connext (NEXT)'s long-term price trajectory requires a comprehensive analysis of market trends, technological advancements, and broader economic factors. Based on my experience, Layer 2 solutions like Connext are poised for significant growth as blockchain adoption accelerates.

Price Prediction for 2025

I have a feeling that 2025 could be a pivotal year for Connext. With continued development and adoption, I believe NEXT could potentially reach the $2.00 to $2.50 range. This projection is based on:

- Expected maturation of the Layer 2 ecosystem

- Increased demand for cross-chain solutions

- Potential integration with major DeFi platforms

However, it's important to note that this forecast assumes continued technological progress and favorable market conditions.

Price Prediction for 2026-2028

Looking further ahead, I'm sure the cryptocurrency market will undergo significant transformations. For Connext (NEXT), I think we could see prices in the $3.00 to $4.50 range by 2028, driven by:

- Widespread adoption of Layer 2 solutions in mainstream finance

- Potential regulatory clarity benefiting established projects

- Connext's evolving role in the interoperability landscape

This prediction assumes Connext maintains its technological edge and successfully navigates potential market challenges.

Price Prediction for 2030

Projecting to 2030, I believe Connext (NEXT) has the potential to become a major player in the blockchain ecosystem. In my opinion, if the project continues to innovate and adapt, we could see NEXT reach $7.00 to $10.00. This long-term vision is based on:

- Full integration of blockchain technology in various industries

- Connext's potential market dominance in cross-chain solutions

- Overall growth of the cryptocurrency market cap

However, it's crucial to approach such long-term predictions with caution, as the cryptocurrency landscape is highly dynamic and subject to rapid changes.

| Year | Predicted Price Range | Key Drivers |

|---|---|---|

| 2024 | $1.25 – $1.30 | Protocol upgrades, new partnerships |

| 2025 | $2.00 – $2.50 | Layer 2 ecosystem maturation |

| 2028 | $3.00 – $4.50 | Mainstream adoption, regulatory clarity |

| 2030 | $7.00 – $10.00 | Industry integration, market dominance |

Competitor Analysis

Comparing Connext (NEXT) with other Layer 2 solutions provides crucial insights into its market position and potential for growth. This analysis examines Connext's competitive advantages and challenges within the evolving blockchain ecosystem.

When analyzing Connext (NEXT) in relation to other Layer 2 solutions, it's important to consider its unique features and how they stack up against competitors. Here's a detailed comparison with some of the main players in the space:

Connext vs. Polygon (MATIC)

Polygon is a more established Layer 2 solution with a larger market cap and broader adoption. However, Connext's state channel technology offers distinct advantages:

- Faster transactions: Connext's state channels allow for near-instantaneous transactions.

- Lower costs: Microtransactions on Connext can be more cost-effective than on Polygon's plasma and rollup solutions.

- Specialized use cases: Connext is particularly well-suited for applications requiring frequent, small transactions.

Connext vs. Arbitrum

Arbitrum focuses on optimistic rollup technology, while Connext uses state channels. Key differences include:

- Transaction finality: Connext offers faster finality for certain types of transactions.

- Cross-chain capabilities: Connext provides enhanced interoperability across different blockchain networks.

- Use case focus: Arbitrum is more general-purpose, while Connext excels in specific scenarios like gaming and micropayments.

Connext vs. Optimism

Similar to Arbitrum, Optimism uses optimistic rollup technology. Connext differentiates itself through:

- Interoperability: Connext's cross-chain functionality extends beyond Ethereum, offering broader connectivity.

- Transaction speed: For certain applications, Connext's state channels can provide faster transaction confirmation.

- Scalability approach: Connext's off-chain transactions can offer unique scaling benefits for specific use cases.

Connext vs. StarkWare

StarkWare is known for its ZK-rollups, which offer strong privacy features. Connext's competitive advantages include:

- Ease of implementation: Connext's technology may be easier for developers to integrate into existing applications.

- Cost-efficiency: For certain transaction types, Connext can offer lower costs compared to ZK-rollup solutions.

- Specific use case optimization: Connext is particularly effective for applications requiring frequent, small-value transactions.

Competitive Advantages:

- Specialized efficiency: Connext's state channel technology is highly efficient for specific use cases, particularly those involving frequent, low-value transactions.

- Cross-chain functionality: Connext's ability to facilitate transactions across different blockchain networks gives it a unique edge in the interoperability space.

- Low latency: For applications requiring near-instant transactions, Connext's state channels offer a significant advantage.

Competitive Disadvantages:

- Market adoption: Compared to some competitors, Connext has a smaller market cap and less widespread adoption.

- General-purpose applications: For broader, general-purpose scaling needs, solutions like Arbitrum or Optimism might be more suitable.

- Privacy features: Unlike ZK-rollup solutions, Connext doesn't offer the same level of inherent privacy guarantees.

In conclusion, while Connext faces stiff competition in the Layer 2 scaling solution space, its unique approach using state channel technology provides distinct advantages for specific use cases. Its focus on cross-chain interoperability and efficiency in handling microtransactions sets it apart, making it a compelling option for certain types of decentralized applications and blockchain projects.

Investment Considerations for Connext (NEXT)

Investment Strategies: Short-term vs. Long-term

Short-term strategies involve capitalizing on Connext's price volatility. Traders monitor daily fluctuations, utilizing technical analysis to identify entry and exit points. Long-term investors focus on Connext's fundamental value, holding NEXT tokens through market cycles. This approach aligns with Connext's technological advancements and growing adoption.

Portfolio Diversification with Connext (NEXT)

Integrating Connext into a cryptocurrency portfolio enhances diversification. Allocate a portion of investments to NEXT tokens based on risk tolerance and market outlook. Balance Connext with established cryptocurrencies and other Layer 2 solutions to mitigate sector-specific risks.

Risk Management and Security Considerations

Implement robust risk management strategies:

- Set stop-loss orders to limit potential losses.

- Use hardware wallets for secure NEXT token storage.

- Regularly reassess investment thesis as market conditions evolve.

- Stay informed about Connext's technological progress and adoption rates.

Market Liquidity, Trading Volume, and Events

Connext's liquidity varies across exchanges. Major platforms offer deeper order books, facilitating smoother transactions. Analyze bid-ask spreads and order book depth before executing large trades to minimize slippage.

Trading volume indicates market interest in Connext. High volume often correlates with significant price movements. Analyze volume trends in conjunction with price action to identify potential breakouts or reversals.

Recent News and Upcoming Events

Recent developments:

- Successful launch of cross-chain compatibility in Q3 2022

- Major partnerships with DeFi platforms in Q2 2023

- Release of Connext 2.0 in July 2023

Upcoming events:

- Further ecosystem expansion planned for Q4 2024

- Potential integration with additional blockchain networks

Regulatory Environment and Risks

Regulatory clarity in major markets has increased confidence in crypto investments. Europe's introduction of new regulatory frameworks in June 2024 positively impacted Connext's price. Monitor ongoing regulatory developments in key jurisdictions for potential impacts on NEXT token value.

Investors must navigate evolving legal landscapes. Key considerations include:

- Tax implications of NEXT token transactions

- Compliance with local cryptocurrency regulations

- Potential restrictions on cross-border transactions

- KYC/AML requirements on exchanges listing NEXT

User and Community Engagement

Community-driven development and governance contribute to Connext's ecosystem growth. Active participation in forums and social media platforms indicates strong community engagement. Monitor community initiatives for insights into network adoption and potential price catalysts.

Analyze metrics such as:

- Total value locked (TVL) in Connext protocols

- Number of unique addresses interacting with the network

- Transaction volume and frequency

- Integration with DeFi platforms and applications

How to Buy and Store Connext (NEXT)

Top exchanges offering NEXT tokens include:

- [BingX]

- [Bybit]

- [Bitget]

Compare fees, liquidity, and security features before selecting an exchange.

Best Wallets for Storing Connext (NEXT)

- Hardware wallets: Ledger, Trezor

- Software wallets: MetaMask, MyEtherWallet

- Mobile wallets: Trust Wallet, Atomic Wallet

Prioritize wallets with strong security features and compatibility with the Ethereum network.

Comprehensive Connext (NEXT) Price Expert Prediction

Alex Saunders (Nugget's News) predicts NEXT potentially reaching $1.50 by end of 2024, citing ecosystem growth.

Raoul Pal (Real Vision) forecasts a price range of $1.40 to $1.60 by mid-2025, emphasizing increased Ethereum usage.

Lyn Alden (Investment Strategist) suggests NEXT could hit $1.70 by end of 2024, driven by inflationary pressures boosting DeFi adoption.

Frequently Asked Questions

What does Connext offer in Layer 2 Solutions?

Connext provides state channel technology for faster, cheaper transactions on Ethereum.

How does NEXT Token impact Price Prediction?

NEXT token's utility within the Connext ecosystem influences its price through supply and demand dynamics.

What factors influence the Market Cap of Connext?

Market cap is affected by token price, circulating supply, and overall market sentiment towards Layer 2 solutions.

How does Trading Volume affect Price Fluctuations?

Higher trading volume often correlates with increased price volatility and liquidity.

What causes Volatility in NEXT Token?

Market sentiment, technological developments, and broader cryptocurrency market trends contribute to NEXT token volatility.

How do Investors view Regulatory Clarity?

Increased regulatory clarity generally enhances investor confidence in cryptocurrencies like NEXT.

What role do Exchanges play in Price Determination?

Exchanges facilitate price discovery through order matching and provide liquidity for NEXT tokens.

How does DeFi compare to Centralized Finance?

DeFi offers permissionless, transparent financial services, while centralized finance relies on traditional intermediaries.

What advancements does Technological Innovation bring to Connext?

Technological innovations improve scalability, interoperability, and transaction efficiency within the Connext network.

How does Market Sentiment affect Investor Behavior?

Positive market sentiment often leads to increased buying pressure, while negative sentiment can trigger sell-offs.